By virtue of reading this, you’re probably one of these things: You’re tired of wondering where your money goes after each payday. You’re a good steward of your money and desire the education that will enable you to manage your money better. You’re neither good nor extremely poor with money management, but deep down, you believe there’s room for improvement.

Whatever category you fall into, one thing holds, managing your money requires consistency and encouragement. We all need a helping hand occasionally, and our financial journey isn’t any different. No judgements!

So, what is a budget, and why do I need one?

A budget is simply a plan for your money. Recall the saying, if you don’t have a plan, then you plan to fail. Well, if you don’t have a well-thought-out and laid plan for your money, you plan to fail with the money. Success is not by chance. It’s deliberate.

A budget is having a vision for your money. It’s assigning a purposeful task to every dime rather than spending it on the go. As often said, money is a terrible master but a loyal servant. A budget puts you in the driver’s seat to be the master of your money. Without a budget, you wouldn’t know how much you can afford to save and spend. A budget breaks down your needs and wants into categories and allocates appropriate spending percentages to them.

How do I create a budget?

Having established enough reasons for why a budget is important, the next question on your mind is, how do I create a budget?

It’s important to note that there are different budgeting types, and budgeting is not a one size fits all approach. Your personal finance journey is personal; therefore, your budget should reflect what matters to you. Things that will help you grow. Some of the budgeting types include:

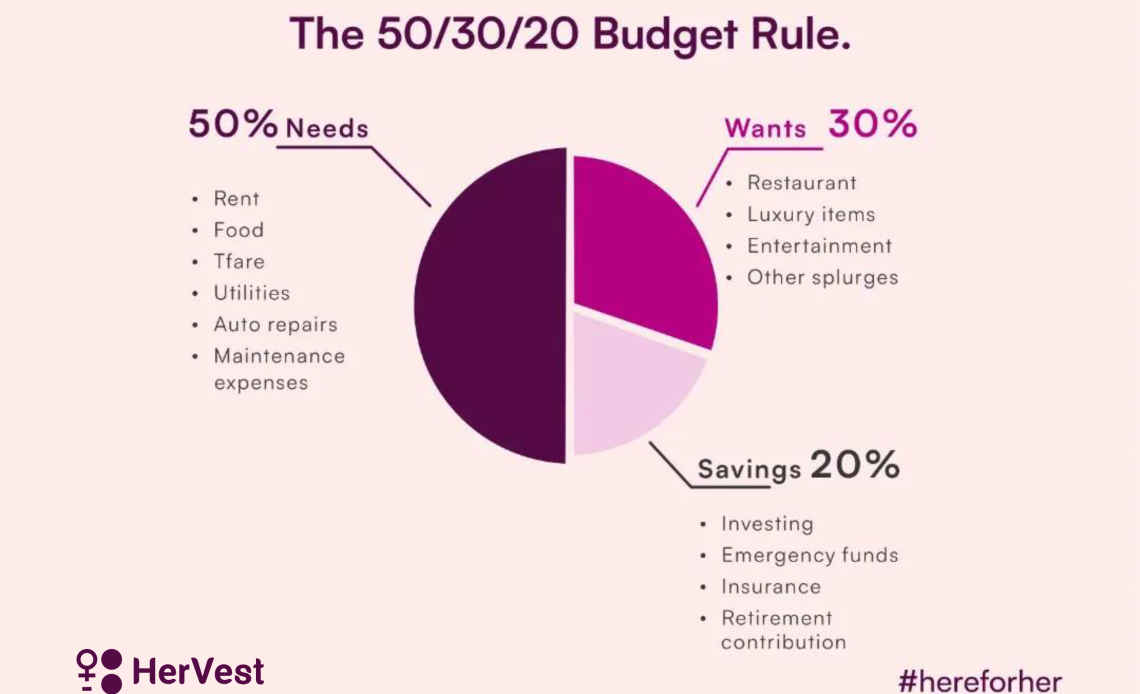

- The 50/30/20 rule

- The 60/30/10 rule

- Zero budgeting rule

- 70/20/10 rule

Let’s discuss the 50/30/20 budgeting rule.

The 50/30/20 budgeting rule was made popular by a US law professor and past senator in the United States, Elizabeth Warren and her daughter, Amelia Warren Tyagi, in their 2006 bestseller, “All Your Worth: The Ultimate Lifetime Money Plan”. She described the 50/30/20 concept as follows: 50% to needs, 30% to wants and 20% to savings and investments.

Let’s demonstrate the 50/30/20 budgeting rule in the life of Clara.

So Clara is a 29-year-old single lady who works in a fintech in Abuja. She earns N150,000 after tax and needs to stick to a budget to help her manage her money effectively and save for a master’s degree.

So here’s a breakdown:

50% goes to Clara’s needs: A need is something you cannot do without. A need is essential for survival. This include food, housing and clothing. Out of her 150,000 salary, Clara allocates 50% to her essentials such as feeding, transportation, electricity, rent, data and airtime. For these must-haves, Clara allocates N75,000 from her income.

30% to Wants: We call this “Nice to haves”. Clara works hard and needs to relax occasionally to enjoy her money. For this, she sets aside 30% of her income towards entertainment, dining out with her girlfriends, new clothes, new shoes, Netflix subscriptions and other things that make her happy.

Finally, 20% of Clara’s salary goes to her savings and investments. That is N30,000. Using the HerVest app, she automates the deposit of N30,000 into her savings account. By automating her savings process, Clara never misses out on paying herself. She stays consistent with her personal finance goals.

Here are some quick tips on setting up a personalized budget:

Set your goals: What do you want to achieve financially in the next three months, six months, one year or even the next three years? Categorically state what you want to achieve and reflect on them. This will help you prioritize your values and keep

Determine your income: What’s your net income? This is your take-home pay after tax. Knowing this will help you understand where you stand financially.

Next is to determine your expenses: Make a list of your fixed expenses( Your needs. Expenses that recur monthly like transport fare and food) and your variable expenses (flexible). Then allocate the appropriate percentages to this expense category using the 50/30/20 rule.

Track your expenses: Always take an inventory of your expenses and budget. Are you on track? Are you overspending in an area? Then make the necessary amendments. Reviewing your expenses from time to time will keep you in check.

Budgeting shouldn’t be a complicated process, nor should the thought of budgeting scare you. The best ways to budget are the simplest.

Do you budget? What budgeting methods do you use?

Enjoy highly competitive interests on your savings and investments. Get the HerVest app to get started.