So you have decided to invest or maybe you are considering investing and are carrying out your due diligence before you make your move, then this write-up is for you!

When it comes to investing, there is no one-size-fits-all approach. Everyone has different financial obligations, goals, income levels and risk profiles. Therefore what works for Shewa may not work for Tema. When investing, you must avoid the “Me-too” approach or “Herd Mentality“.

For example, let’s say Shewa and Tema earn N300,000 in monthly income and Shewa has been saving 50% of her income in the last 5 months to invest in the Stock Market. Let’s say she buys the ABC shares at N11 per share and in a few months, the stock price grows to N200 per share. She is elated and shares the incredible news with Tema. Tema has been looking for opportunities to grow her money outside her salary, so she goes ahead and invests the bulk of her savings in ABC shares. This isn’t considered a smart move and let’s analyse why together.

“Be fearful when others are greedy, and be greedy when others are fearful!”

Warren Buffet

Most people tend to make the mistake of thinking that since Madam A made a killing with this investment then it will work for me. They make quick decisions without taking into consideration their financial goals or obligations. This is what we call Herd Mentality.

Tema and Shewa might earn the same salary but their financial circumstances are different. Shewa is 23 years old and has been living with her parents who financially support her. She only spends her income on transportation, data and lunch at work. If she didn’t invest her savings in the stock market, she would have spent on clothes, travel and entertainment.

Equity is a relatively high-risk investment but historically it gives better returns in the long run than any other asset class and the longer Shewa’s money is invested, the higher the average rate of return. Since she has zero to no obligations and age is on her side. She can afford to take the risk of investing a huge portion of her earnings in the stock market in the long run

Tema on the other hand, is married with 3 children. She and her hubby equally contribute to household expenses from school fees and rent. She’s recently been feeling the inflation pinch and is desperately seeking opportunities to expand her income so when she hears Shewa’s good news, she seizes the opportunity. This isn’t a prudent move because if ABC’s share price goes down, so will the value of her money. Since she needs her money in the short term to foot family expenses, this isn’t considered a wise decision to make.

Before investing, here are 5 steps to consider:

- Understand and establish your investment goals:

Why are you investing? To make more money, travel, buy a new car, build assets or improve your financial future? The reason you are investing will determine the type of asset classes to invest in. Your investment goals should reflect your financial obligations, values and what you want your money to achieve.

2. Make saving a priority:

Every investor needs money to invest. You need money to make money. For most people, this will require setting aside 20% of their income towards an Emergency Funds Plan and Investment Savings. Cultivating the habit of saving before investing will help you become financially disciplined. You will also have more asset classes to explore when you invest because you have the money.

3. Develop an Investment Strategy:

What will you be investing in? Stocks, Bonds, Fixed Income, Real Estate, a friend’s business or sustainable asset classes? How diversified is your investment? What is your asset allocation mix? Before investing, you must ensure that this is well outlined with the help of a trusted financial advisor.

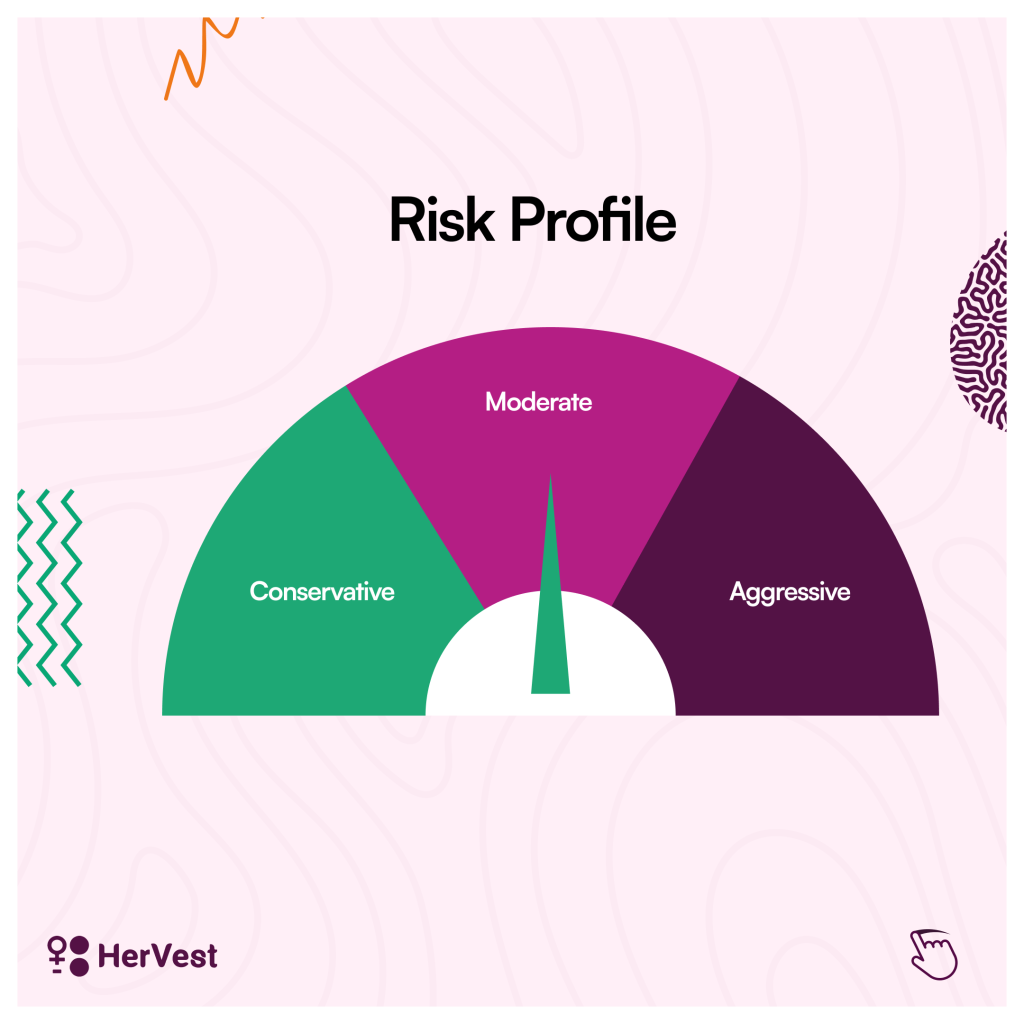

4. Understand Your Risk Profile:

As a potential investor, you need to know your risk profile before investing. This analyses how willing and able you are to take on risks. Your risk profile will determine the allocation of your investment assets in a portfolio. While some products promise higher returns, there might be a higher level of risk involved. Taking more risks than you can tolerate can cause anxiety and ultimately cause you to stop the investment before achieving your goal.

5. Speak to a Financial/ Investment Professional.

After establishing your investment goals and strategy, the next step is to pick an investment firm and have a professional assigned to you. No matter how skilled you are, speaking to an investment professional to pick the right products/ asset classes aligned with your goals is safe.

Make a difference with your investments on the HerVest app. Grow your money by impact investing in Women-owned businesses and farms on the HerVest and earn competitive returns on your money. Download the HerVest app to get started. Available on Android and iOS devices.